This post may contains affiliate links. As an amazon associate I earn from qualifying purchases.

What Is Cap Rate – Understanding Cap Rate in Commercial Real Estate

Cap Rate (Capitalization Rate):

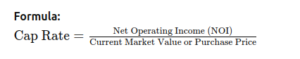

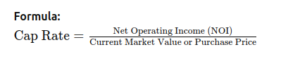

The capitalization rate, or cap rate, is a key metric in commercial real estate used to evaluate the profitability and potential return on an investment property. It is calculated by dividing the property’s net operating income (NOI) by its current market value or purchase price.

The cap rate provides investors with a straightforward percentage that represents the expected annual return, helping them compare the relative value and performance of different properties. A higher cap rate typically indicates a higher return and potentially greater risk, while a lower cap rate suggests a lower return and usually less risk.

In commercial real estate, the cap rate is crucial for making informed investment decisions. Investors use it to gauge the income-generating potential of a property relative to its cost. For instance, a commercial property with a cap rate of 8% means that the property is expected to generate an 8% return on investment annually.

Cap rates can vary significantly based on factors such as property location, condition, tenant quality, and market conditions. Understanding the cap rate helps investors assess whether a property aligns with their financial goals and risk tolerance, ensuring a balanced and strategic investment approach.

Formula:

Example: Let’s say you are considering purchasing a commercial property priced at $1,000,000. The property generates an annual net operating income (NOI) of $80,000.

In this example, the cap rate is 8%, meaning you can expect an 8% return on your investment annually, based on the current net operating income and purchase price.

This post may contains affiliate links. As an amazon associate I earn from qualifying purchases.